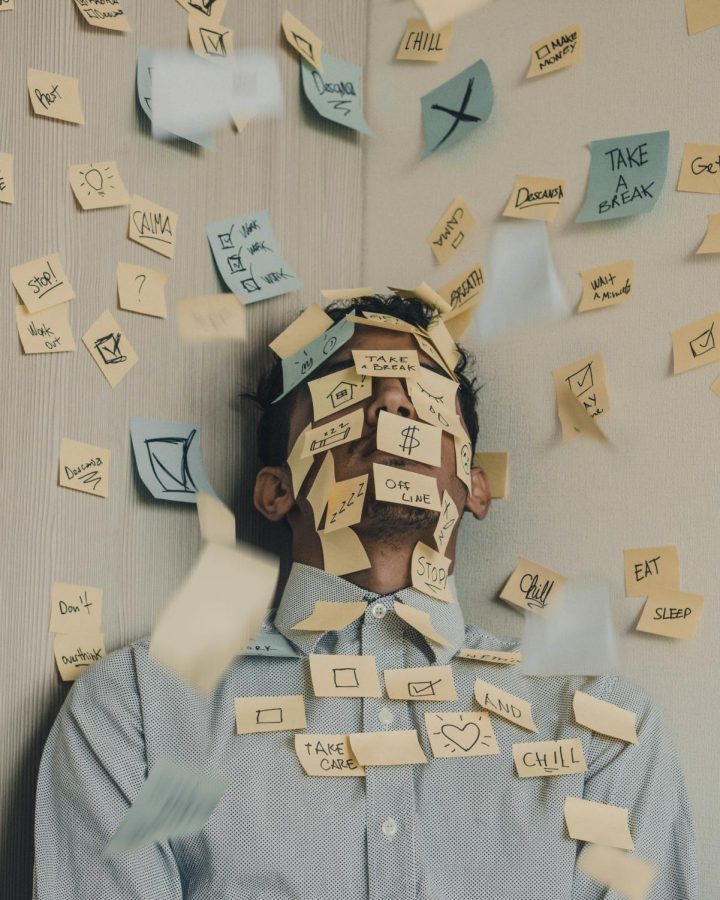

It’s an English 12 honors class and our teacher asks “what do you guys want to learn before you graduate?” The overwhelming majority votes for post-high school finances. We all had questions about credit cards, loans, investment, and how to budget. The senior students at Canton High School felt that once they graduated they were not prepared for what comes next in terms of financials.

High school is where students are first thrown into the financial world. We get our first job, have to open a bank account, and learn how to do our taxes. Last, but not least, we have to learn how to budget. Some people learn this early from parental figures, but others are left to navigate by themselves.

The Connecticut General Assembly passed a legislation, June 2023, that requires students who enter high school to take a financial literacy course. The class of 2027 will be the first to have this requirement. Connecticut is not the only state that has found they need to prepare their students better for their future. Along with Connecticut “21 other states require a personal finance course to graduate from high school.”

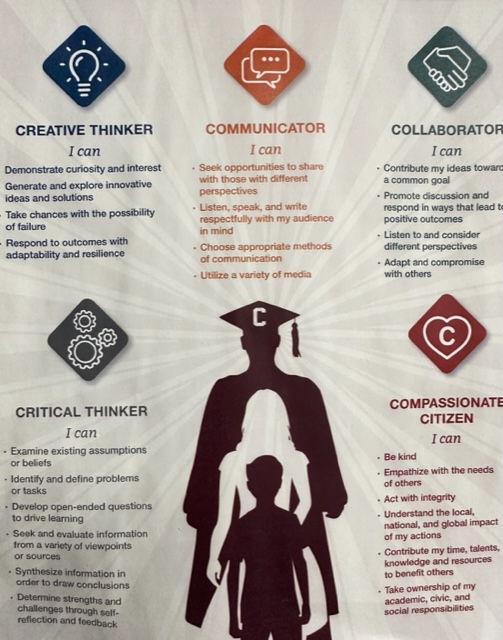

Learning these skills early is imperative to future success. According to the Federal Deposit Insurance Corporation, “financial education has been linked to lower debt levels, higher savings, and higher credit scores as children mature into adulthood.” It’s important to educate students before they are thrown into a complicated financial world. Financial literacy helps you achieve your goals and dictates your future.

John Peltier, the director of the Center for Financial Literacy at Champlain College, says that the increase in attention to a financial curriculum is due to “higher inflation which has strained consumers’ budgets, and the resumption of student loan payments has renewed worries about student debt.” Also, the growing concern about racial financial disparities.

Kawame Owusu-Kesse, owner of nonprofit, said that the work his company does “is an acknowledgment that education alone cannot bridge the gap in wealth, which has been growing along racial lines for decades.” Some schools have gone above and beyond to try and help students’ futures. Mr. Owusu-Kesse’s nonprofit group in New York City gave thousands of students each $10,000 to invest. Along with a financial course, these students were given money that they could only use to advance their financial portfolio, such as buying a house. The goal of this project is to give every student a chance at being successful.

I took a personal finance course my junior year of high school. I took it just for the credits at first, but it became very informative. I learned how to complete a FAFSA, budget, and file my taxes. I also learned about investment and how to start early. I changed a lot of my habits after this class. I started the 50/30/20 budget. I was able to file my own taxes and I started planning for the future with retirement and college loans.

It’s very important to educate the younger generations for the future of the economy. Due to this new legislation, no more high school seniors will feel the impending doom of not understanding finances before they go off into the world.